In principle, it would, of course, be desirable to have stable exchange rates. For private individuals, travel and vacations may be the main focus. International trade and cross-border cooperation and investments are relevant for economic growth, which would benefit significantly from being able to better plan future financial flows. Fluctuations in exchange rates have mainly three negative effects:

The elimination of these problems is one of the main reasons for political decisions to stabilize exchange rates, as is the case in the euro zone, for example. Here, within a given group, exchange rates are fixed among themselves (a French euro is always worth as much as a German one), but flexibility is maintained with regard to currencies outside the group. For example, in the first 10 years of its existence, the euro has already depreciated by 25% against the US dollar and then appreciated by 85%, only to depreciate by 30% again. There have been fluctuations of 37% in one year (from January 2002). The successes, in the form of more intensive cross-border economic activity and higher growth rates, have been empirically proven many times over.

At the same time, however, the weakness of exchange rate fixation is also evident. Exchange rates are one of the compensatory mechanisms between economies that develop differently. In simple terms, the currency of an economy that is doing badly will depreciate, i.e. less foreign currency will have to be paid for a unit of the domestic currency. As a result, goods that this economy wants to export become cheaper and thus get demanded more, which in turn boosts the economy. The reverse is true for booming nations whose rising exchange rates are dampening growth. If this balancing mechanism is eliminated by fixing exchange rates, other mechanisms have to be created or existing ones need to be strengthened.2

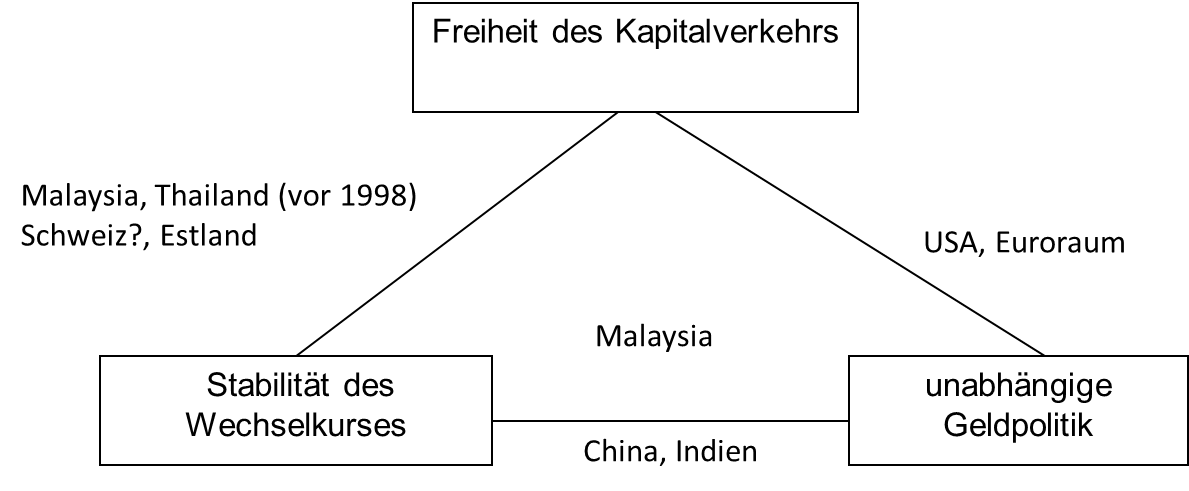

The magic triangle of monetary policy describes the trade-off between the three main objectives of the international dimension of monetary policy:

The conflict of objectives now consists in the fact that not all three objectives can be achieved at the same time, but only two at a time. If one wants to pursue an autonomous monetary policy and allow free movement of capital, then exchange rates cannot remain fixed. Fixed exchange rates and autonomous monetary policy require restrictions on the movement of capital, and free movement of capital can only go hand in hand with fixed exchange rates if the monetary policy follows the monetary policy of an anchor country.

Why is this? Let us imagine that in an equilibrium situation, an interest rate increase takes place abroad. Then the attractiveness of this currency as an investment increases, since the yield increases. This increases the demand for this currency (free movement of capital) and thus its price, the exchange rate. If the central bank wants to keep the exchange rate stable, it has three options: (1) prevent the increase in demand by restricting the free movement of capital, (2) counteract the increase in demand by increasing its own supply (foreign exchange market intervention) or (3) also by raising interest rates to compensate for the relative difference in attractiveness (non-autonomous monetary policy).

In the following, three fundamental exchange rate theories will be briefly discussed: the interest parity theory, the purchasing power parity theory and the AA-DD model. The interest parity theory focuses on the short term, keeps and fixed, and explains the relationship between , , , and . The purchasing power parity theory, on the other hand, analyzes the long-term relationship between , , and , where is considered flexible and fixed. In the AA-DD model (goods market-asset market model), with fixed and flexible , the relationship between and is analyzed in the medium term.

2Optimal Currency Areas- theory (OCA- theory) deals with exactly this issue.